Joboh Samurai > Useful information > Welfare Pension Insurance

Welfare Pension Insurance

What a Welfare Pension Insurance

Employees' Pension Insurance is a system in which insurance benefits are provided when workers are unable to work due to old age, become permanently disabled due to sickness or injury, or when the main provider of a family dies and the family is in need of financial support.

Joining

In general, those who work more than 30 hours a weekare eligible for Welfare Pension Insurance. From October, 2008, the rule was expanded tocompanies that have 501 employees or more and who work 20 hours or more per week.

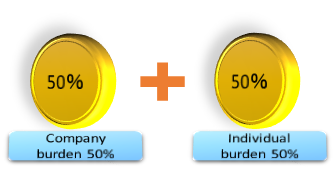

Insurance Premium Burden

Calculation method of welfare pension insurance premium

◆Welfare pension insurance premium=standard remuneration (monthly)×welfare annuity insurance rate

◆The standard remuneration (monthly) is determined by rank (grade) of the amount of monthly remuneration.

Example)(Tokyo) Monthly income 225,000yen ⇒ Remuneration Monthly Grade [ 210,000 - 230,000] ⇒ Standard Remuneration (Monthly) 220,000yen

◆Health insurance premium = 220,000yen × 18.182 % = 40,000.4yen

From this amount, individual burden = 40,000.4 × 50% = 20,000.2yen

Company burden = 40,000.4 × 50% = 20,000.2yen

※For generally insured person.

※Excluding welfare pension fund members